3 Reasons to Offer Incorporation and Business Startup Services to Your Small Business Customers

Let's face it, the bank is a small business owners strongest ally.

As one of the earliest partnerships on the road to success, your bank has a unique opportunity to foster long lasting relationships as a strategic advisor for small business owners.

As a strategic advisor, you understand your role as a knowledgeable and trusted resource for small business owners.

You also understand that every small business is unique, and that their success is your business.

Learn how our Incorporation Services help position your bank as strategic advisor who can help clients open the accounts necessary for small business success.

Expand your strategic advisor services.

Engage with new small business customers.

Add lifetime value to your business clients.

1. Expand Your Strategic Advisor Services

Your customers want to open a bank account for their business. However, they may not have their tax ID, or they may not have completed the necessary corporation or LLC formation paperwork.

Our Incorporation Services allow banks to provide customers with these services without any additional workload.

Our team of filing experts handle the process from start to finish, completing the required paperwork on behalf of the customer, allowing clients to seamlessly open business accounts while avoiding common hurdles and pitfalls.

An EIN also allows businesses to hire employees and build business credit. That's a win for the customer, and a win for the bank.

"Your customers need help with business registration filings. They look to their banks to provide them with guidance and assistance."

2. Engage with new small business customers.

As a strategic advisor, you have a fantastic opportunity to educate business customers about what it means to incorporate a business. It's equally as important that clients understand the risks that come with being an unincorporated business.

These risks may create long-term issues which may have negative impacts on the company:

- Putting personal assets at risk.

- Difficulty establishing a strong brand reputation.

- Inability to open a business bank account.

3. Add lifetime value to your business clients.

Our incorporation services go beyond helping your customers meet their business' banking requirements. The services offered provide value throughout the entire life cycle of a small business.

- Help customers file a DBA and obtain locally required business licenses.

- Provide resources for annual/biannual maintenance filings.

- File trademark and copyright applications

- Close a business by filing a dissolution

Clients can continue to look to you well after their business has opened its doors. Over time, this adds lifetime value to their businesses earns your bank a reputation as a trusted strategic business advisor.

How do financial institutions and MyCorporation work together?

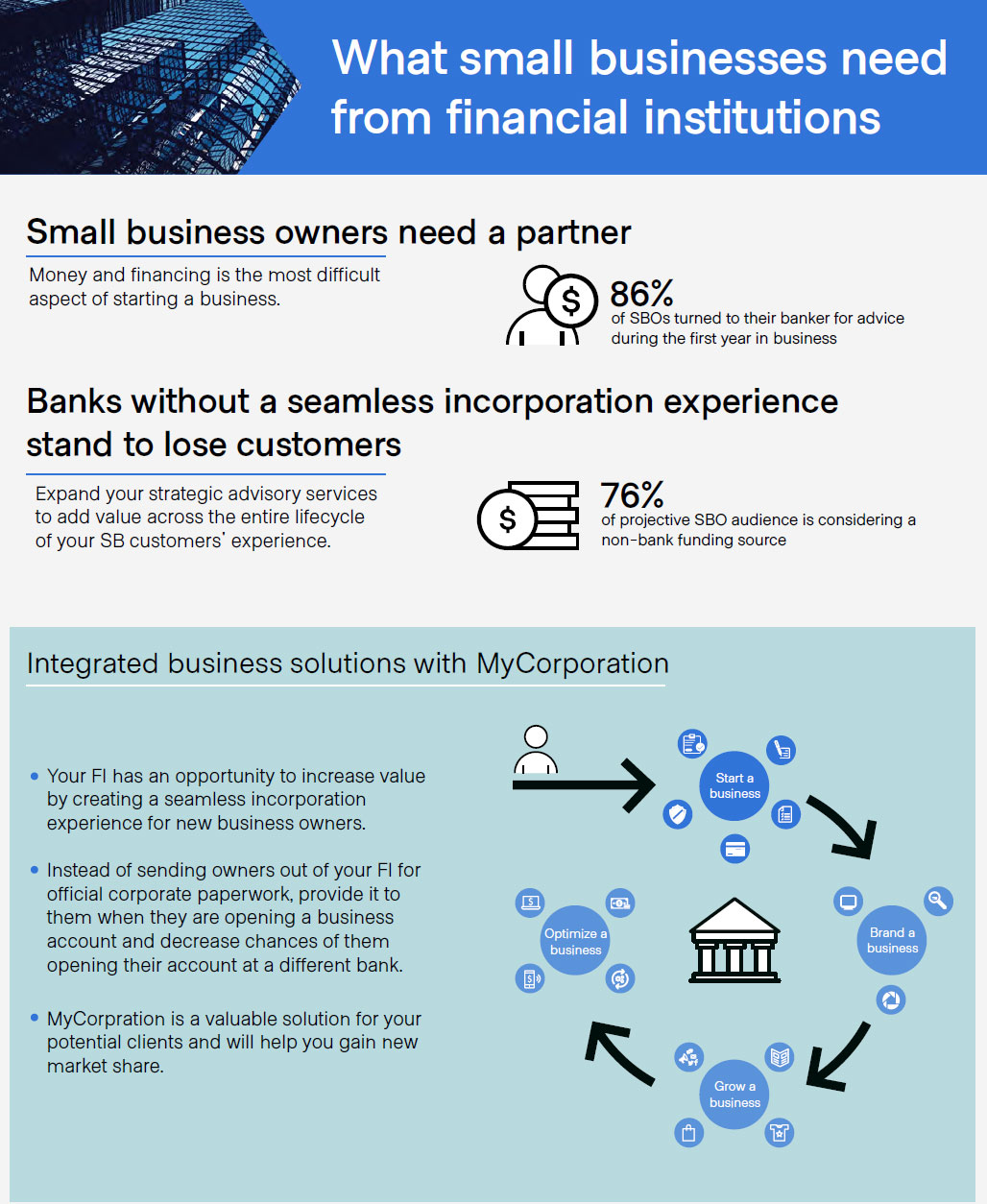

We've created the simple infographic seen below to help you understand how we fit into your existing work flow.